Property Tax Rate In Floyd County Ky . This interactive table ranks kentucky's counties by median property. property taxes on this page apply to the following cities in floyd county, kentucky: for comparison, the median home value in floyd county is $66,700.00. welcome to the floyd sheriff's office property tax search page. 121 rows kentucky property taxes by county. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. The county tax bills are due and payable starting october. If you need to find your property's most recent tax. the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. The constitution expressly prohibits exemption of any. all property, unless specifically exempt by the constitution, is taxable.

from taxfoundation.org

the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. The constitution expressly prohibits exemption of any. If you need to find your property's most recent tax. for comparison, the median home value in floyd county is $66,700.00. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. 121 rows kentucky property taxes by county. property taxes on this page apply to the following cities in floyd county, kentucky: This interactive table ranks kentucky's counties by median property. welcome to the floyd sheriff's office property tax search page. all property, unless specifically exempt by the constitution, is taxable.

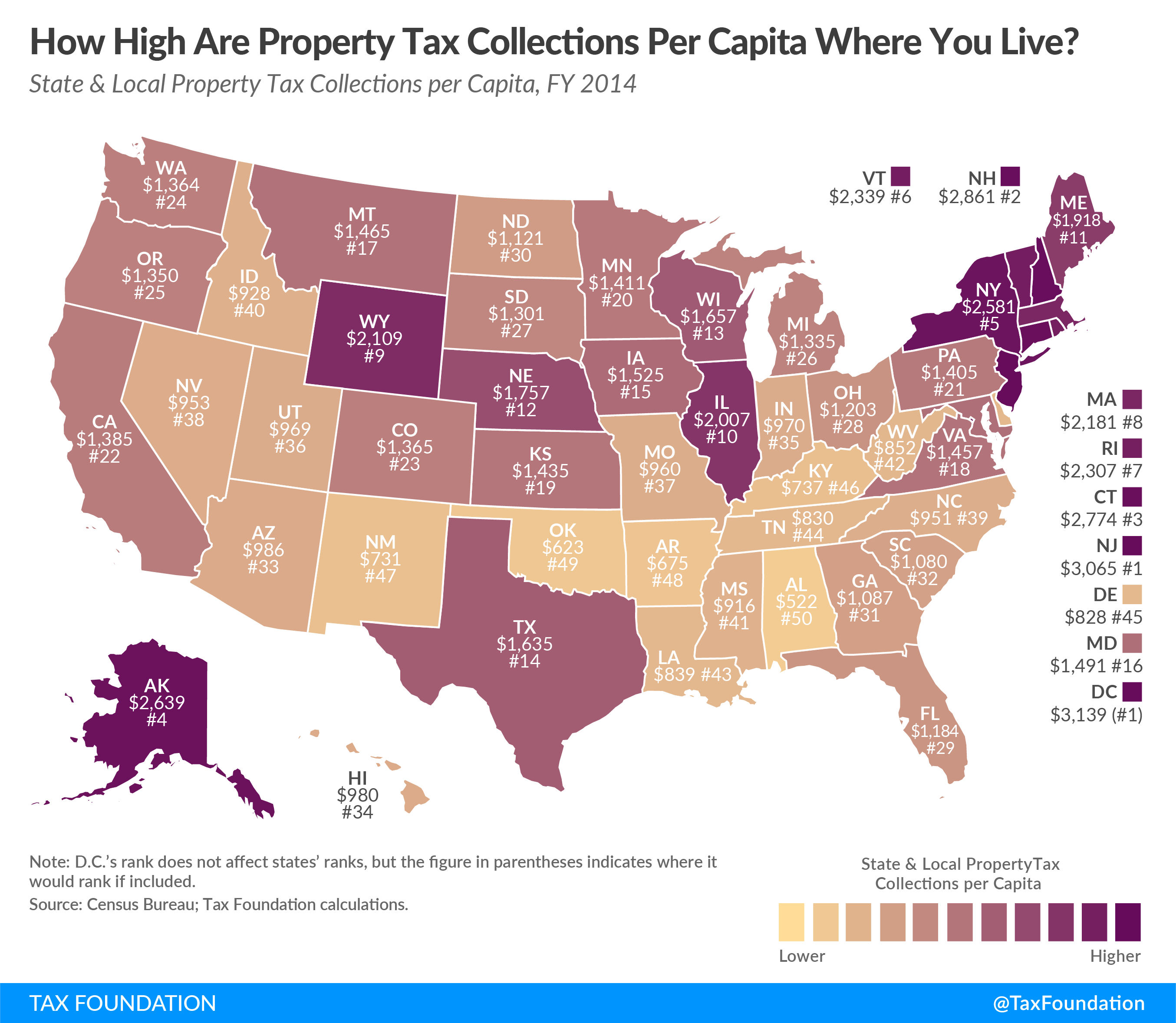

How High Are Property Tax Collections Where You Live? Tax Foundation

Property Tax Rate In Floyd County Ky the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. welcome to the floyd sheriff's office property tax search page. This interactive table ranks kentucky's counties by median property. for comparison, the median home value in floyd county is $66,700.00. property taxes on this page apply to the following cities in floyd county, kentucky: 121 rows kentucky property taxes by county. If you need to find your property's most recent tax. the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. The county tax bills are due and payable starting october. The constitution expressly prohibits exemption of any. all property, unless specifically exempt by the constitution, is taxable.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate In Floyd County Ky all property, unless specifically exempt by the constitution, is taxable. welcome to the floyd sheriff's office property tax search page. This interactive table ranks kentucky's counties by median property. If you need to find your property's most recent tax. 121 rows kentucky property taxes by county. The constitution expressly prohibits exemption of any. for comparison, the. Property Tax Rate In Floyd County Ky.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate In Floyd County Ky welcome to the floyd sheriff's office property tax search page. This interactive table ranks kentucky's counties by median property. The constitution expressly prohibits exemption of any. 121 rows kentucky property taxes by county. If you need to find your property's most recent tax. The county tax bills are due and payable starting october. the median property tax. Property Tax Rate In Floyd County Ky.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Floyd County Ky for comparison, the median home value in floyd county is $66,700.00. welcome to the floyd sheriff's office property tax search page. 121 rows kentucky property taxes by county. the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. property taxes on. Property Tax Rate In Floyd County Ky.

From www.land.com

19 acres in Floyd County, Kentucky Property Tax Rate In Floyd County Ky welcome to the floyd sheriff's office property tax search page. The county tax bills are due and payable starting october. The constitution expressly prohibits exemption of any. for comparison, the median home value in floyd county is $66,700.00. 121 rows kentucky property taxes by county. If you need to find your property's most recent tax. this. Property Tax Rate In Floyd County Ky.

From www.land.com

2 acres in Floyd County, Kentucky Property Tax Rate In Floyd County Ky If you need to find your property's most recent tax. 121 rows kentucky property taxes by county. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. all property, unless specifically exempt by the constitution, is taxable. the median property tax (also known as real estate. Property Tax Rate In Floyd County Ky.

From dxotsgkpj.blob.core.windows.net

Property Tax Rates By County In South Dakota at Sandra Johnson blog Property Tax Rate In Floyd County Ky for comparison, the median home value in floyd county is $66,700.00. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. 121 rows kentucky property taxes by county. This interactive table ranks kentucky's counties by median property. The county tax bills are due and payable starting october.. Property Tax Rate In Floyd County Ky.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate In Floyd County Ky the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. for comparison, the median home value in floyd county is $66,700.00. The county tax bills are due and payable starting october. this publication reports the 2022 ad valorem property tax rates of the. Property Tax Rate In Floyd County Ky.

From www.joancox.com

Property Tax Rates Property Tax Rate In Floyd County Ky The county tax bills are due and payable starting october. the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. 121 rows kentucky property taxes by county. welcome to the floyd sheriff's office property tax search page. property taxes on this page. Property Tax Rate In Floyd County Ky.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate In Floyd County Ky property taxes on this page apply to the following cities in floyd county, kentucky: welcome to the floyd sheriff's office property tax search page. 121 rows kentucky property taxes by county. for comparison, the median home value in floyd county is $66,700.00. The constitution expressly prohibits exemption of any. If you need to find your property's. Property Tax Rate In Floyd County Ky.

From www.mapsales.com

Floyd County, KY Zip Code Wall Map Basic Style by MarketMAPS MapSales Property Tax Rate In Floyd County Ky This interactive table ranks kentucky's counties by median property. all property, unless specifically exempt by the constitution, is taxable. The county tax bills are due and payable starting october. The constitution expressly prohibits exemption of any. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. for. Property Tax Rate In Floyd County Ky.

From mapsontheweb.zoom-maps.com

Property Taxes by US County, 2019. Maps on the Property Tax Rate In Floyd County Ky the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. If you need to find your property's most recent tax. property taxes on this page apply to the following cities in floyd county, kentucky: 121 rows kentucky property taxes by county. this. Property Tax Rate In Floyd County Ky.

From www.floydco.iowa.gov

Budgets, Levy Rates, Valuations & Audit Reports Floyd County, IA Property Tax Rate In Floyd County Ky If you need to find your property's most recent tax. for comparison, the median home value in floyd county is $66,700.00. 121 rows kentucky property taxes by county. all property, unless specifically exempt by the constitution, is taxable. welcome to the floyd sheriff's office property tax search page. This interactive table ranks kentucky's counties by median. Property Tax Rate In Floyd County Ky.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Property Tax Rate In Floyd County Ky all property, unless specifically exempt by the constitution, is taxable. welcome to the floyd sheriff's office property tax search page. The county tax bills are due and payable starting october. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. 121 rows kentucky property taxes by. Property Tax Rate In Floyd County Ky.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Floyd County Ky this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. the median property tax (also known as real estate tax) in floyd county is $455.00 per year, based on a median home value of. welcome to the floyd sheriff's office property tax search page. If you need. Property Tax Rate In Floyd County Ky.

From www.charlescitypress.com

Floyd County approves new fiscal year budget with property tax hikes Property Tax Rate In Floyd County Ky The constitution expressly prohibits exemption of any. all property, unless specifically exempt by the constitution, is taxable. The county tax bills are due and payable starting october. If you need to find your property's most recent tax. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. . Property Tax Rate In Floyd County Ky.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Floyd County Ky 121 rows kentucky property taxes by county. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. welcome to the floyd sheriff's office property tax search page. The county tax bills are due and payable starting october. property taxes on this page apply to the following. Property Tax Rate In Floyd County Ky.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate In Floyd County Ky this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. The county tax bills are due and payable starting october. 121 rows kentucky property taxes by county. property taxes on this page apply to the following cities in floyd county, kentucky: The constitution expressly prohibits exemption of. Property Tax Rate In Floyd County Ky.

From wallethub.com

Property Taxes by State Property Tax Rate In Floyd County Ky 121 rows kentucky property taxes by county. The constitution expressly prohibits exemption of any. property taxes on this page apply to the following cities in floyd county, kentucky: If you need to find your property's most recent tax. welcome to the floyd sheriff's office property tax search page. the median property tax (also known as real. Property Tax Rate In Floyd County Ky.